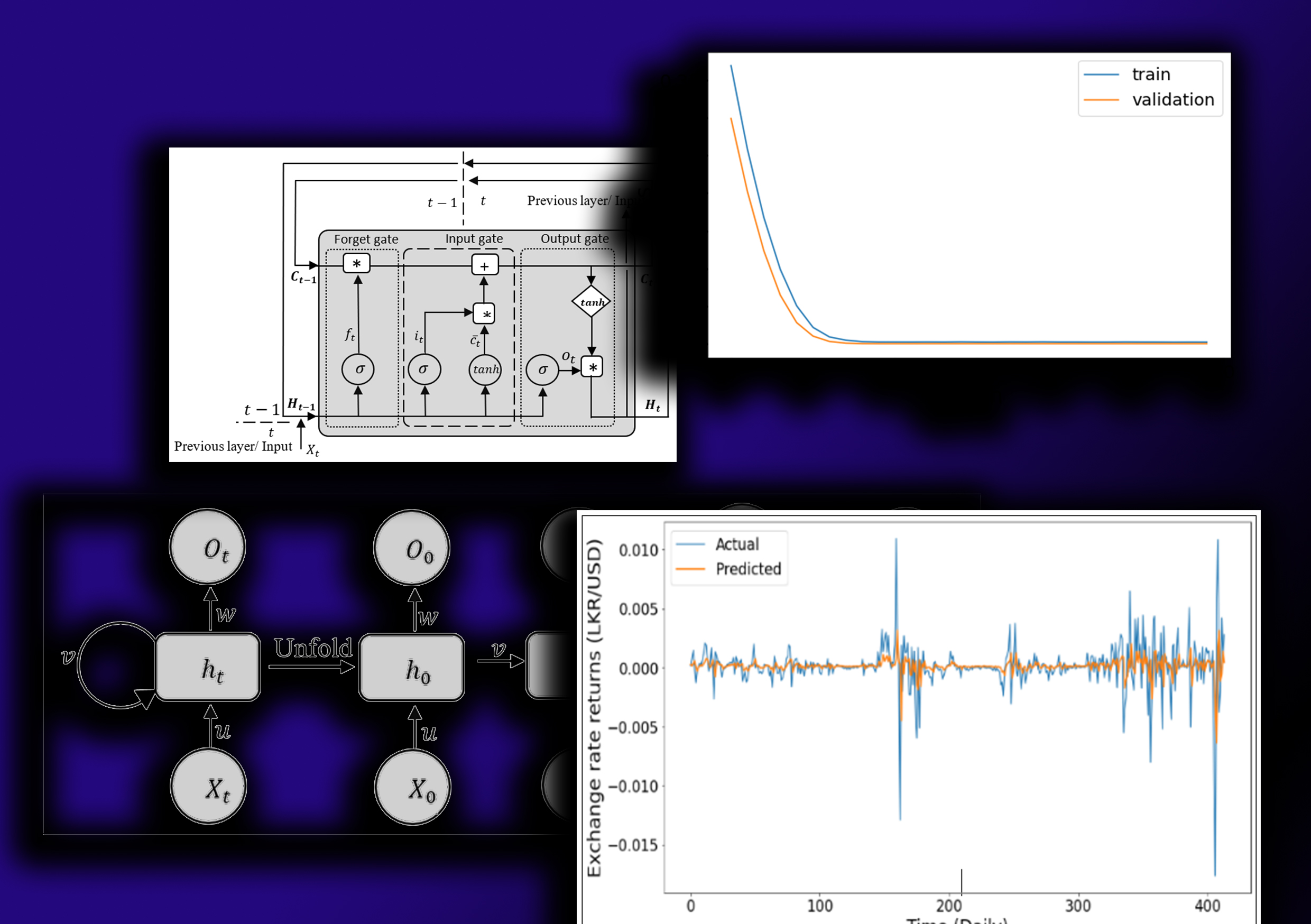

Forecasting USD/ LKR Daily Exchange Rate with Long-Short Term Memory Neural Network

##plugins.themes.academic_pro.article.main##

Abstract

As Sri Lanka is an open economic country since 1977, a large share of the country's economy is depending on imports as of today. International trade is often based on the US dollar and the changes in US dollar rate relative to Sri Lankan Rupee (USD/LKR exchange rate) is significantly affected on the shape of the country's economy. Having a prior understanding about the fluctuations of the exchange rate is very important for both government and private sectors as their monetary policy-making process, investments decisions and import-export activities are highly depending on the exchange rate. The main objective of this study is to identify an accurate forecasting model to forecast volatility of the daily USD/LKR exchange rate using Recurrent Neural Network (RNN) based Long Short-Term Memory (LSTM) Neural Network. Daily data of USD/LKR exchange rate from 1st January 2015 to 30th April 2021 obtained from the Central Bank of Sri Lanka (CBSL) were used in the study and it was found the existence of the volatility clustering over the study period. The data set was divided in to two parts viz. Training set and Testing set, where each containing 70% and 30% of the whole data respectively. The “ADME” LSTM model was selected as the optimization algorithm and “TanH” was selected as the activation function. The hyperparameters that lead to a better generalization of the model were identified while validating the model. The accuracy of the identified model was evaluated by using Root Mean Square Error (RMSE), Mean Absolute Error (MAE) and Mean Squared Error (MSE) which results in 0.002072, 0.001071 and 4.293544e-06 respectively.